Our qualified and dedicated team is responsible for the financing of investments in nearly all economic sectors. In Corporate and Project Financing, we have proven to be a key business partner for high developmental impact projects as well as providing financing opportunities for large companies, public and mixed-capital entities.

We provide our clients with bespoke advisory and financial services aimed at meeting their strategic objectives. Our offerings, extending beyond conventional and unconventional solutions, range from loans to tailor-made financing opportunities such as bonds and securitization as well as non-recourse and limited recourse project financing.

Benefits that our clients derive from partnering with us includes:

Our Expertise

We assist our clients balance risk and profitability, while maximizing their wealth and stock value in the steps below;

Our Range Of Offerings

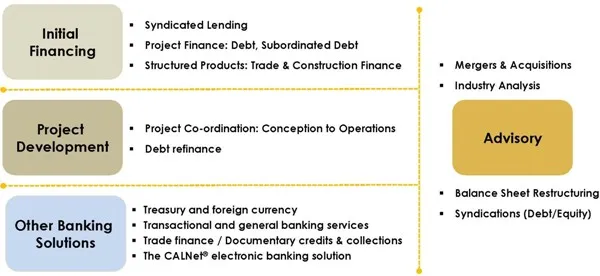

We believe that each client is unique and at such we provide each one with well-suited offerings including:

This has been summarized as:

We finance our clients’ projects from the bank’s resources and/or we also partner other banks and institutional investors to participate on a co-financing basis through the sale of loan participations.

Facilities can also be used to refinance existing debts by companies that have demonstrated sound management and corporate governance, potential for growth and competitiveness, and a sustainable financial plan.

To find out more, get in touch with us now on

Tel – (233-302) 680783

Fax – (233-302) 668253

Mobile: 0261510331 / 0261510280 / 0263777230

Email: cpfd@hermestb.com

Powered by Exceed